Esports investments dominate news headlines just about every week here at Esports Insider, and for good reason — the industry is new, exciting, and an effective way to reach young audiences.

It seems everyone from venture capitalists to celebrities is cashing in on the action, so you’d assume that an esports investment would be easy money. We asked venture capitalists: When should an investor realistically expect to see a return on investment in esports?

Investment time is relative

“The timeframe on return is highly contingent on the price that you paid at the start,” says Josh Chapman, Co-founder and Managing Partner of Konvoy Ventures, which invests in esports-related ventures, including Askott Entertainment.

Chapman says that Konvoy expects a time horizon of between three-to-10 years before seeing a return, hanging on to investments for an average of five-to-seven years.

“If you invested at a rational, fairly priced valuation, I could see a return in 24-48 months, maybe,” he said. “Your time horizon on a return is highly contingent on the price you paid at entry because that will impact whether or not you’re willing to sell at a future price. You see a lot of these leagues or teams being bought for pennies on the dollar and that’s not actually a reflection of the inherent value or the demise of an organization or a brand or esports tech — it was just mispriced and now it’s being fairly priced.”

The type of investment can have a major impact on how quickly you can expect ROI in esports, as well. A studio, for example, might yield returns faster if a game is successful, while an esports team is a longer-term investment with more risk due to turnover in players, leagues, ownership, and so on. Technology is also a long-term bet because of the private sector, Chapman added.

Felix LaHaye, Founding Partner of esports-focused Archmage Ventures, says that ROI will depend more on the type of venture than how much you put in initially.

“I don’t think how much you invest in esports is a factor in terms of when to expect a return on investment,” he said. “However, the majority would probably be 5+ years. I think it depends on what kind of venture you’re investing in and what type of ROI you expect.

“To me, the esports companies are teams, infrastructure, media, and tech. Anything tech is likely to follow the same path as it would normally — a few unicorns and a lot of busts. I think that teams have the longest ROI scope simply because we see teams being associated with different groups but not being bought completely out of the market right away.”

Recognise unique esports investment risks

One of the biggest draws for esports investment is how new it is, with everyone scrambling to get in on the ground floor. Being a young industry, as it turns out, is a double-edged sword for investors.

“Esports is still in very early days of its maturity,” says Chapman. “I’d say we’re in the 2nd or 3rd inning of esports right now. We’ve certainly come a long way but technology and video streaming have allowed esports to hit an inflection point in the last 3-5 years but we’re still figuring it out. A healthy appreciation of that is required.

“If you think about investing in the esports market and putting $50M to work, you just covered 0.5% of the entire market size. You have to understand this is still a small market.”

Another thing to consider, Chapman warns, is that the lasting popularity of any particular video game is never guaranteed.

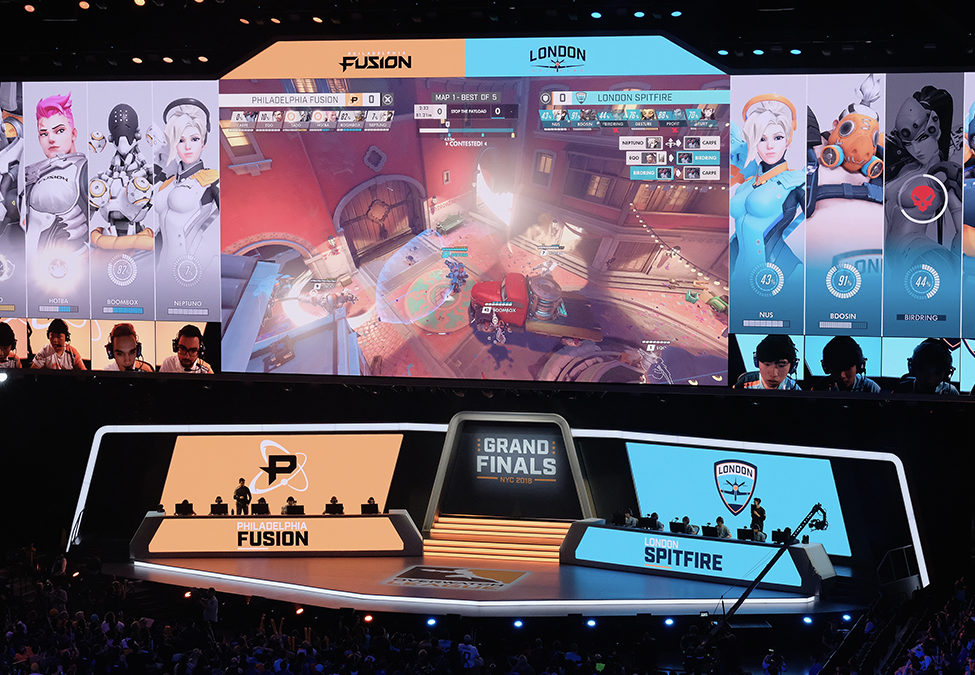

“Realize that when you’re investing in esports, you’re investing in games that are finite,” he said. “These games come and go, unlike traditional sports, where games and sports are sticking around for over 100 years. You can see this with Overwatch League (OWL), where viewership is down over 64% from season 1 […] because the game has increased competition and is finite by nature.”

This is true of almost every game, Chapman said, noting that exceptions will always exist like CS:GO, Dota 2, and League of Legends.

“A lot of people come into esports, bought into these franchise leagues, expecting Overwatch to be a household name over the next 10-20 years. Since then, we’ve had Apex Legends, Warzone, VALORANT… a lot of competition has entered. That’s not going to stop, even for the new entrants.

“If you come into esports, realize that you have to take risk-adjusted bets based on the fact that these games come and go. That’s critical, and something I think a lot of people have missed in the last 3-4 years. They’re gonna lose a lot of money.”

Listen to ESI Network, a suite of esports podcasts